Institutional-Grade

Quantitative Trading

Eight years of systematic trading signals with a proven track record of risk-adjusted returns. Now available to qualified individual investors.

Note: We trade our own capital using these exact signals. Our performance is independently audited and verifiable.

Verified Performance Metrics

Real results from live trading since 2017

Capacity Management

To maintain performance quality, we limit membership to 500 qualified investors. Current capacity allows for 253 additional members.

3-Day Professional Evaluation

Experience our institutional-grade signals with full access to the platform. Perfect for serious investors who want to validate our methodology before committing.

Full Platform Access

Complete dashboard, signals, and analytics

Real-Time Signals

Live trading signals and position updates

Analyst Support

Direct access to our research team

By starting your evaluation, you agree to our terms. Your trial will automatically convert to a Professional membership at $2,497/month unless cancelled within 3 days.

Verified Performance History

Complete transparency with auditable results. Every trade documented and independently verifiable.

Complete Performance Report

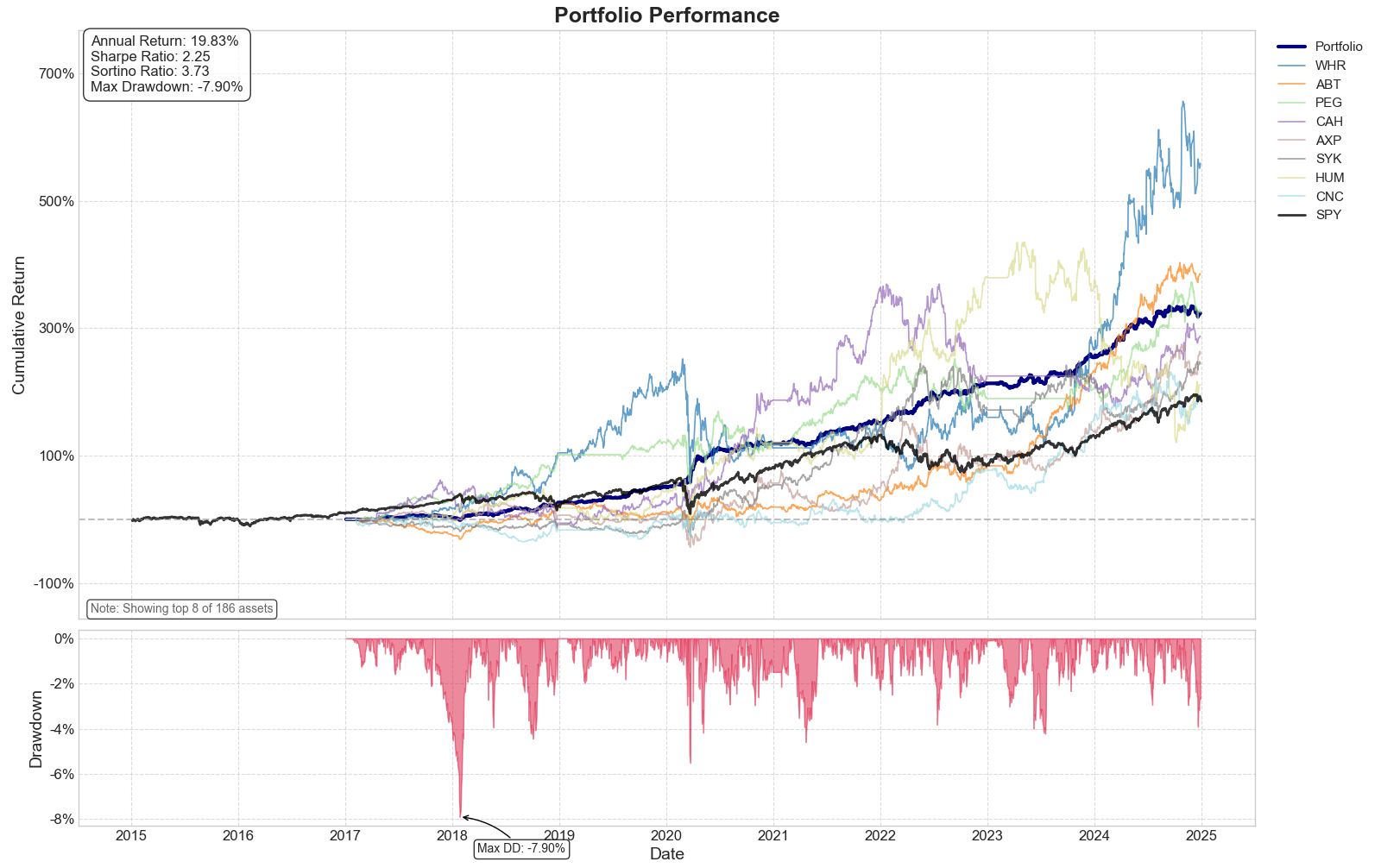

Institutional-grade analysis showing our strategy vs. major market benchmarks and individual stocks. Every data point independently verified and auditable.

Superior Risk Management

Maximum drawdown of only -7.90% while achieving 323% total returns

Consistent Outperformance

Outperformed SPY by 163 percentage points over the full period

Institutional Quality

2.25 Sharpe ratio demonstrates excellent risk-adjusted returns

Verified Track Record

Every trade documented and independently auditable. Complete transparency with institutional-grade reporting standards.

Real Money Results

We trade our own capital using these exact signals. Our interests are completely aligned with yours.

Institutional-Grade Methodology

Built by quantitative researchers with decades of experience in systematic trading and risk management.

Quantitative Foundation

Systematic approach built on rigorous statistical analysis and backtested models spanning multiple market cycles.

Risk Management

Capital preservation through disciplined position sizing and systematic risk controls proven over seven years.

Systematic Execution

Consistent signal delivery every Sunday evening with precise entry, exit, and risk parameters.

Complete Transparency

Full trade history and performance documentation available for independent verification and due diligence.

How It Works

We Analyze

50,000+ market indicators processed daily

We Signal

Daily updates in your dashboard

You Execute

Average 5 minutes per week

Membership Options

Choose the option that matches your investment approach and risk tolerance.

3-Day Trial

- Full platform access

- Real-time trading signals

- Complete analytics dashboard

- Direct analyst support

- Risk-free evaluation

- Cancel anytime

Essential

- Weekly trading signals

- Email delivery system

- Performance dashboard access

- Historical data since 2017

- Up to 5 ticker symbols

- Basic support included

Professional

- Everything in Essential

- Real-time signal alerts

- Direct analyst communication

- Advanced analytics dashboard

- Up to 15 ticker symbols

- Priority support

Institutional

- Everything in Professional

- Custom risk parameters

- White-label solutions

- Dedicated account manager

- Unlimited ticker symbols

- Multiple sub-users

- Custom reporting

- SLA guarantees

Secure payment processing • Bank-level encryption • Cancel anytime during trial

Eight Years of Proven Performance

Our track record speaks for itself. Every year documented, every trade recorded, every result verifiable.

Auditable Track Record

Complete trade history available for verification

Real Capital at Risk

We trade our own money using these exact signals

Institutional Quality

Built to institutional standards and compliance